non ad valorem tax florida

3 rows Tax collectors are required by law to annually submit information to the Department of Revenue on. Non-Ad Valorem tax rolls are prepared by local governments and are certified to the tax collectors office for collection.

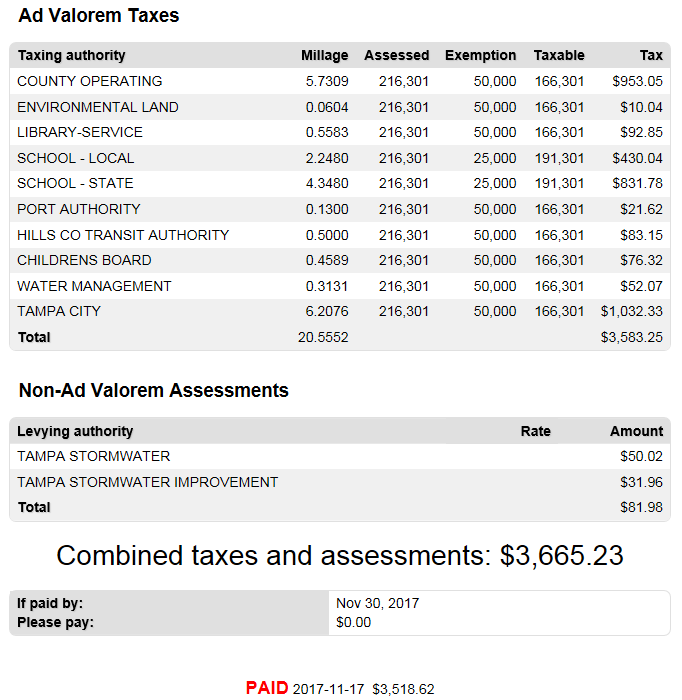

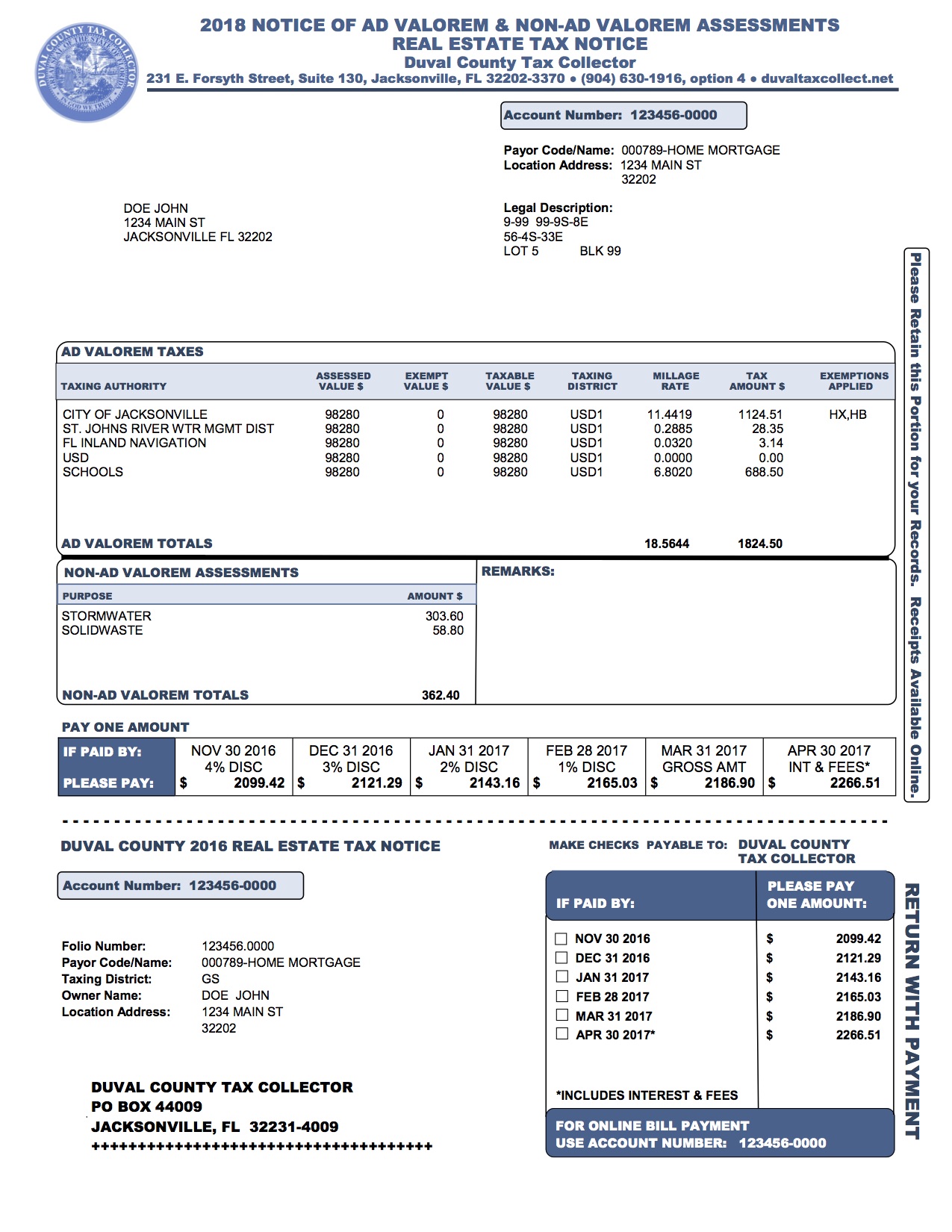

Ad valorem taxes and non-ad valorem assessments are due November 1.

. 16464 365 x 214 days 3118-10118 9653 this amount will appear as a debit to Buyer and a credit to Seller If you are not sure of the. Non Ad Valorem Assessment is a charge or a fee not a tax to cover costs associated with providing specific services or benefits to a property. 1973632 or in accordance with other collection measures provided by law.

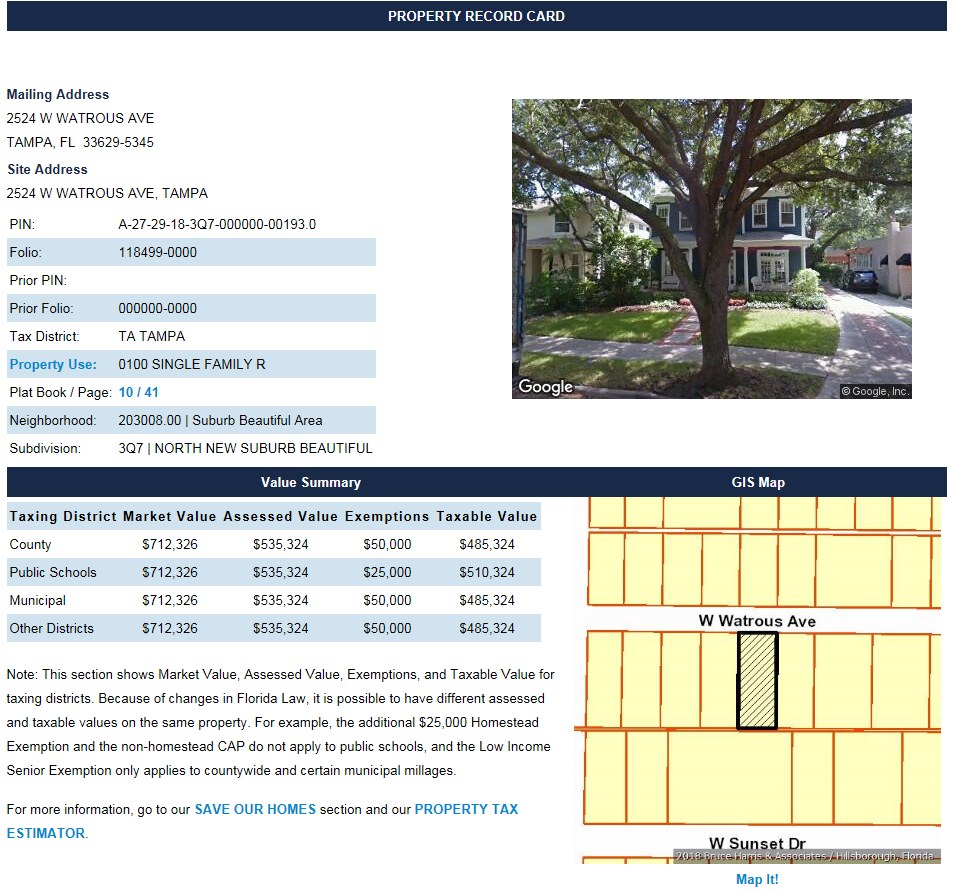

A Non-Ad Valorem Assessment is a legal financing mechanism or method wherein the County establishes a special district to allow a group of citizens to fund a desired improvement such as utilities or roads by majority consensus 51 of the approval of the property owners contained in the assessment area. Fiscal Year taxes 10117 93018 13494 Solid Waste Service District a Non-Ad Valorem assessment 3656 Stormwater Utility a Non-Ad Valorem assessment 17150. Florida real estate taxes often include different types of taxes and assessments.

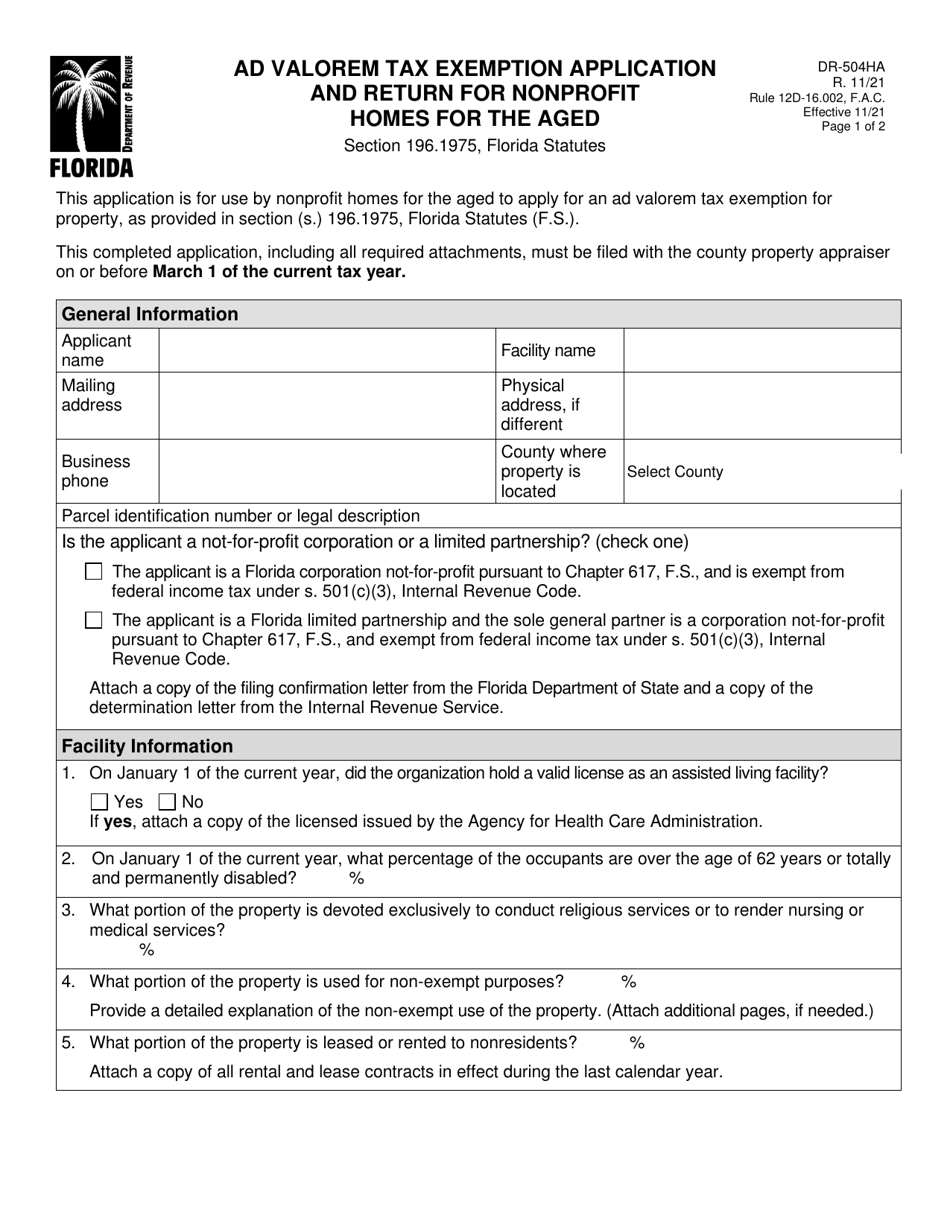

Special assessments can be placed on the tax roll only if they are also non-ad valorem assessments Non-ad valorem assessments are defined as only those assessments which are not based upon millage and which can become a lien against a homestead as permitted in Fla. And we have non-ad valorem taxes which are based on other elements. The Legislature first defined non-ad valorem assessment in 1988 in section 1973632ld Florida Statutes.

The real estate tax bill is a combined notice of ad valorem taxes and non-ad valorem assessments. 686 4 discount. The statute did not how-ever invent or create a new or different type of local government levy on property.

Non-ad valorem assessments are assessed to provide certain benefits to your property including services such as landscaping security lighting and trash disposal. Select one of the access methods listed below if you would like additional information. A non-ad valorem assessment is a special assessment or service charge which is.

These non-ad valorem assessments may be collected at the districts discretion by the tax collector pursuant to the provisions of s. This notice becomes a. These taxes and assessments are sometimes assessed by their taxing authorities on different accounting periods.

The ad valorem taxes are based on a calendar year January 1st to December 30th and are paid in arrears. Each special assessment board calculates the amount to be assessed and provides the Tax Collector with a non-ad valorem assessment roll. They may be expenses for other items though like rental property or businesses.

Non-ad valorem assessments are primarily assessments for paving services storm water and solid waste collection and disposal. They are NOT considered property taxes for Schedule A although some exceptions may apply see comments below. Proposed non-ad valorem assessment increases that exceed the rate set the previous fiscal year or the rate previously set by special act or county ordinance whichever is more recent by more than the average annual growth rate in florida personal income over the last 5 years or the first-time levy of non-ad valorem assessments in a district.

Inquiry by Parcel Number. Non-ad valorem assessments collected within their own area include Telephone Number. Non-ad-valorem assessments are based on the improvement or service cost allocated to a property and are levied on a benefit unit basis rather than on value.

They become delinquent April 1 and the law imposes an interest rate of up to 18 a year plus other costs or fees. For example we have ad valorem taxes which are based on the appraised value of the real property. Levying authorities are responsible for setting the non-ad valorem assessments.

Non-Ad Valorem Taxes Non-ad valorem assessments are based on factors other than the property value such as acreage or number of units. In some states such as Florida a taxpayers bill includes both ad valorem taxes and non-ad valorem taxes. Counties in Florida collect an average of 097 of a propertys assesed fair market value as property tax per year.

A non-ad valorem assessment is a special assessment or service charge which is not based on the value of the property. Inquiry by Owner Name. The collection of taxes as well as the assessment is in accordance with the rules and regulations of the Florida Department of.

The statute defines non-ad valorem broadly to cover. The collection of taxes as well as the assessment is in accordance with the rules and regulations of the Florida. Marion County has provided several ways in which you can access information related to your propertys assessments.

The collection of taxes as well as the assessment is in accordance with the rules and regulations of the Florida. Non-Ad Valorem assessments are primarily assessments for paving services storm water and solid waste collection and disposal. Florida Statute 200001 provides a more detailed breakdown of the millage rate categories.

Non-Ad Valorem assessments are primarily assessments for paving services storm water and solid waste collection and disposal. For example the tax for a homeowners property ad valorem tax is also included on the. Non-ad valorem taxes In Nassau County all non-ad valorem special assessments are a flat rate with the exception of SAISSA which uses a value-based calculation.

Tax Sale Certificates for the unpaid property tax will be sold by June 1. When purchasing a property with a non-ad valorem assessment the sales price of the property. What is a non-ad valorem assessment.

NonAd Valorem Assessment Period for which services are rendered and assessed on Nov 2021 Tax Bill Miramar Storm Water October 1 2021 through September 30 2022 Monterra Community Development District October 1 2021 through September 30 2022 North Lauderdale Fire October 1 2021 through September 30 2022.

What Is A Non Ad Valorem Tax Miami Real Estate Lawyers Fleitas Pllc

What Is A Non Ad Valorem Tax Miami Real Estate Lawyers Fleitas Pllc

A Guide To Your Property Tax Bill Alachua County Tax Collector

County Property Tax Payment Deadline Jennifer Sego Llc

Broward County Property Taxes What You May Not Know

Property Taxes Highlands County Tax Collector

Form Dr 504ha Download Fillable Pdf Or Fill Online Ad Valorem Tax Exemption Application And Return For Nonprofit Homes For The Aged Florida Templateroller

Tax Certificate And Tax Deed Sales Pinellas County Tax

What Is This Trim Notice I Received From The Property Appraiser Lubin Law Property Tax Appeals South Florida

Estimating Florida Property Taxes For Canadians Bluehome Property Management

Real Estate Taxes City Of Palm Coast Florida

Understanding Your Tax Bill Seminole County Tax Collector

Estimating Florida Property Taxes For Canadians Bluehome Property Management